Its Past and Future - UK 1984 edition

This out of print 1984 paperback is transcribed on the web without permission, because it reads like Robert Peston's missing volume 1: what happened before the banking boom.

p134-135, where chapter 7 starts, dropped-out of the transcription for a year by mistake. Sorry to those who read it garbled.

There is a pirate note at the end. A later 1989 edition had an extra chapter, not yet found to transcribe. The cover calls the book "A new three-part introduction to the British economy - the background, current theories and possible future".

Introduction

There is a significant difference between economic problems and an economic crisis. All economies face more or less severe problems, all of the time. Some may result from the basic structure of the system itself, such as the 'cycles' of unemployment and recession which plague capitalist economies: they are due in large part to the absence of any central coordination in and between such economies. Socialist economics, built on central coordination and planning, are stable by comparison, and rarely face problems of unemployment. Yet their very centralization generates other problems: enterprises are often inefficient compared with those of the capitalist world, perhaps because they lack the spur of competition, and they find difficulties in generating and sustaining real technological progress. Added to these inherent structural features, countries often have problems due to accidents of nature or geography - shortages of natural resources, for example, or problems of climate. Then there may be difficulties deriving from the framework of institutions and policies and pressures within which the economy functions: the absence of a centralized pay-bargaining system makes the operation of the British economy very different from that of Sweden, for example, where pay is often settled at a national level for whole groups of industries simultaneously. There may be problems from unpredictable shocks to the system, such as the OPEC price rises of 1973-4, or the chaos caused in the international financial system by the way the United States financed its war effort in Vietmam. Finally there are problems arising from mistakes in decision-making. The Concorde project, or the Russian TU144, or the West German construction of a nuclear-powered merchant ship - which turned out to require an annual operating subsidy of several million pounds - are examples. If

12 • THE BRITISH ECONOMIC CRISIS

the projects are big enough, and if such mistakes occur often enough, the economic consequences can be very serious.

The mere existence of problems like these - even in severe forms - does not indicate a crisis. It would, in fact, be wildly unrealistic to think of an economy functioning without at least some of the difficulties sketched above. A crisis, in the sense the term is used in this book, is something more, for it is not a matter of problems within an economic system, but a question of the viability of the system itself. A crisis occurs when the types of activity on which an economy is based, and the levels of income which it generates, are no longer sustainable. To put it a different way, one could say that economic problems - of the kinds outlined above - can be lived with, they can be adapted to, but a crisis entails inevitable change. Large-scale transformation becomes unavoidable, and this can take the form either of a positive attempt to overcome the critical difficulties (which may not necessarily involve any earth-shattering upheavals), or a process of decline and maybe collapse. There are plenty of historical examples of these paths. Should, however, the current predicament of the British economy be interpreted as a crisis of this type? No one can deny that the situation is serious. Yet there are a number of ways in which it could be read. One argument is that we are indeed in the throes of a crisis, but that the positive response has already begun. Britain is even now engaged in a process of transition in which the seeds of future success are being sown: this was the view taken by Sir Geoffrey Howe - then Chancellor of the Exchequer - in his speech at the Mansion House to an audience of City bankers and merchants in late 1982:

There is plenty of economic pessimism about, at home and abroad. In this country and throughout the world, there are those who question whether there can ever be a return to prosperity ... But I am certain that the problems we see are those of change, not of decay. To be sure, transition is painful and the pace of recovery slow. But ... long overdue change, evolution, innovation are at last being willingly embraced: we are on the right path.On the other hand there are people who disagree sharply with Sir Geoffrey, yet who share his faith in the viability of the present economic system in Britain. They might be described as being, to use

INTRODUCTION • 13

a cant term, in the 'centre' of British politics (meaning they can be found in large numbers in all of the political parties). For them the economic structure within which Britain has functioned since the late 1940s remains workable: what is needed is a change of government, and a modification or reversal of `Thatcherite' policies, and recovery will follow. It is thus the policies which are being carried out within the present economic framework which are the problem, not the framework itself.

This book shares neither of these views. It argues that the recession of the late 1970s and early 1980s marks a fundamental turning-point, for it has been superimposed on a long-term economic decay which has now reached a point of no return. The weak and hesitant recovery from the recession may continue into the mid 1980s, but cannot resolve Britain's industrial and economic crisis: the economic structure with which Britain emerged from the Second World War, and which carried the country with some success and much failure through the 1950s and 1960s, is no longer workable. The British economy is indeed in crisis; without far-reaching changes further sharp decline is inevitable within the near future and if it occurs may well prove irreversible.

The following chapters explain why this is so. They begin with a description of Britain's relatively poor economic performance over a long historical period, and establish why this poor performance now has the dimensions of a genuine crisis. Britain's economy, and the jobs and living standards of everyone in Britain, have for many years been dependent upon a complex system of foreign trade and inter-national economic relationships; within this system the manufacturing sector of the British economy has played a crucial role. The importance of the 'de-industrialization' of Britain since the mid 1960s lies in the fact that the relationship between Britain's foreign trade and its manufacturing capability has now broken down. Only the fortuitous emergence of North Sea oil has enabled Britain to continue as though nothing has happened. When oil output declines, as it will in the very near future, Britain will face desperate economic problems. Understanding why this impasse has been reached requires not just a description of the course of Britain's ever more precipitous decline, but also the development of some theoretical ideas in order to explain

14 • THE BRITISH ECONOMIC CRISIS

it. These are mainly to do with the nature of economic growth, with the relationship between economic growth and technological change, and with the interaction between growth, technological change, and the external performance of the economy. Economics is not, unfortunately, a field in which theoretical ideas can be altogether avoided. But the issues are not, even for non-specialists, necessarily difficult to understand, and those which are outlined in the first chapters will form the basis for interpreting the decline which will be described in subsequent chapters. Part One of this book is concerned, therefore, with an account of the 'Thatcher recession' of 1979-81, set against the background of the long-term decline which it has accelerated rather than solved. Part Two deals with the theoretical foundations of economic policy, concentrating on the so-called Monetarist-Keynesian debates of recent years; it is argued that the confrontation between them is frequently spurious, and to a very considerable extent irrelevant to the serious economic problems Britain faces. Finally, problems of industrial recovery are discussed, with an argument for an active policy of government intervention for industrial reconstruction, along the lines of that carried out in Japan, whose highly successful methods of industrial intervention are described in detail.

PART ONE :

THE CRISIS

1

The Crisis Behind the Recession

The word 'crisis' has become slightly overused in Britain in the past few years. The main reason, of course, is that Britain's economic performance since the advent of Mrs Thatcher - especially between 1979 and 1981 when the economy entered a major recession - has seemed so much worse than what came before. In many ways it is indeed much worse, and this will be described in detail below. Unfortunately, implicit in a lot of recent crisis talk is the idea that overcoming it simply means reversing the economic effects of Mrs Thatcher, and getting back to the general trend of economic develop-ment, the forms of economic administration, and the kinds of social priorities which preceded her. However, it should be remembered that the economic situation which Mrs Thatcher inherited was in fact a grim one. Unemployment had been on an upward track for over a decade, inflation (though well down from its mid 1970s peak) was again rising, and manufacturing industry was shedding jobs and per-forming poorly in export markets. Many of the nationalized indus-ries, and quasi-nationalized industries such as British Leyland, were in deep trouble. The National Health Service and public services generally were starved of funds and investment. So, simply on these grounds, the idea that the crisis is purely to do with Margaret Thatcher is mistaken. But it follows, at the same time, that if the Thatcher administration or any other government were to return Britain to the pre-Thatcher level of 1979, the British people would have little to celebrate, for that year was the end-point of a prolonged decline. It was a good year only in comparison with what was to follow.

So the UK economy suffers from two separable processes: a short-term recession - which might be called the 'Thatcher recession' - and a long-run decline. The mechanisms at work in these processes were

18 • THE BRITISH ECONOMIC CRISIS

quite different, and recovery from one set of problems does not mean recovery from the other.

However, if Margaret Thatcher is not responsible for the real economic crisis which faces Britain, this does not mean that the economic effects of her administration are not serious. In late 1979, primarily as a result of her policies, the economy entered a recession which bears comparison with the 'Great Depression' of the 1930s. Since 1979, unemployment has increased by approximately 250 per cent. In the two years from mid 1979 to mid 1981, manufacturing output fell by 18 per cent, while overall national income fell by 71 per cent. These falls are bigger, and happened faster, than those of the Great Depression. And it should be remembered that these figures, dramatic though they are, are merely averages, which means that while some industries and areas are better off than the figures indicate, others have been hit much harder. Regions such as Scotland, Wales, the West Midlands and the North West, and cities such as Liverpool, have far higher than average unemployment. Industries such as metal manufacturing (output down 25 per cent between 1979 and 1981), textiles (down 26 per cent), clothing and shoes (down 21 per cent), timber and furniture (down 21 per cent) and general metal goods (down 26 per cent) were especially badly affected. Even such normally strong performers as mechanical engineering (down 16 per cent) and chemicals (down 9 per cent) were hard hit. New housing starts in 1980 were 165,000 fewer than in 1970, after ten years of rising population and increasing need (and the fall in building occurs in the context of an increasingly decrepit housing stock). In 1980 also, over 27,000 companies went into liquidation, as opposed to 6,000 in 1977 and about 5,000 in 1978. These are signs of an economy in serious trouble. Why did it happen?

THE 'THATCHER RECESSION'

We can start, perhaps, with a paradoxical feature of the post-1979 recession. This is that the large falls in manufactured output and in Gross Domestic Product (GDP) - or total output produced in Britain - were not accompanied by falls in total personal incomes or consumer spending. As the recession took hold in 1980, GDP began a steadyTHE CRISIS BEHIND THE RECESSION • 19

decline, manufacturing output fell sharply, and employment fell spectacularly: yet personal disposable income (that is, the total of all individual incomes after tax) actually rose, as did total expenditure by consumers. Even when disposable income finally fell slightly - by about 2 per cent in t981 - consumer expenditure continued to increase. So the recession did not take the form of falling incomes and demand by consumers.

Yet since a recession is nothing other than a decline in output - either absolutely, or in terms of its rate of growth - it must mean that somewhere along the line the consumption of output is slowing down or falling. For one reason or another, one of the end users of output is demanding and consuming less, and falling production and employment are a response to that falling demand. So where did this happen in Britain? Apart from consumer demand, the other major categories of final demand are capital formation (expenditure on such things as new buildings, machines, equipment, etc.), government expenditure and exports. However, all of these remained more or less stable. To find the main cause of the recession we need to look to another source of demand, one which is in fact within the very companies which are producing output. This is a demand for inventory, or stocks of goods: that is, the stocks of raw materials, semi-completed products and completed output which firms hold for various reasons. To see why this 'stockpile' demand collapsed, we need to look first at the broad objectives of Thatcherite policy, then at the measures used to achieve those objectives, and finally at the effects of those measures on companies in Britain.

The Thatcher government came to office committed to the defeat of inflation as its primary goal; this was part of a wider programme for restoring market forces and market values as the basis of 'sustainable growth'. The first step, reduced inflation, was to be achieved through controlling the quantity of money in the system. How to control the money stock is, among economists at least, a vexed question; indeed there is hardly agreement on what the money stock actually is. Unassailed by doubts, however, the government decided on a double-barrelled strategy. On the one hand this was aimed at controlling the supply of money (controlling, in particular, the activities which caused governments to want to expand the money supply),

20 • THE BRITISH ECONOMIC CRISIS

and on the other hand controlling the demand for money (meaning, in practice, restricting the demand for credit from banks). The guilty party in expanding the money supply, it was argued, was government borrowing. The problem was a gap between government spending and its income from taxation; this gap, which has averaged between five and ten billion pounds per year in recent years, is the budget deficit, the basis of the 'Public Sector Borrowing Requirement' (PSBR). So the policy decision was to attempt to restrict spending and thus cut borrowing. This would both inhibit monetary growth, and also lower interest rates (since when the government borrows it naturally pays interest, and excessive borrowing - it was argued - raises interest rates).

The attempt to restrict the impact of the PSBR on interest rates was important, for a related measure in the government's monetary control policy was a rise in interest rates. One of the ideas behind this is that the banking system is in effect capable of creating money through the overdraft system. The way to restrict the demand for overdraft credit is to raise its cost. Thus a lower quantity of money implies an increase in interest rates. This rise occurred: the 'base rate' for bank overdrafts was 12 per cent when the government took office; it subsequently rose by 2 per cent, then another 3 per cent, and stayed in the range 16-17 per cent through most of 1980.

This policy had a devastating effect on industrial and commercial companies in Britain. Since most companies were unable to raise prices in line with the interest rate increases, it amounted to a sharp increase in their costs. This affected in particular the source of demand referred to above, namely for inventory or stocks within the company sector of the economy.

Industrial companies normally maintain three kinds of inventory. They are, firstly, raw materials - these are held in order to even out possible fluctuations in availability, so that a regular supply of inputs is available. Secondly, there is work in progress, semi-completed output. Finally, there are finished goods - firms may want to meet fluctuations in demand which cannot be met out of current output, and will maintain stocks of their product for that purpose. Thus a steel mill will keep stocks of iron ore, oxygen, etc., beyond its im-mediate requirements; a ear assembly plant will have stocks of sheet

THE CRISIS BEHIND TIIE RECESSION • 91

steel, wheels, engines and so on, and a ear company might hold a quantity of finished cars. These stocks can be large: in recent years they have been equivalent to about 30 per cent of total annual output.

But the problem with stocks is that they must be paid for. Both raw materials and the labour which turns them into components or finished products are normally paid for before the product is finally sold. Frequently, therefore; companies borrow in order to finance both current production and stockbuilding. In recent years they have done so increasingly through bank overdrafts, often on a very large scale.

For companies running large overdrafts, the government's monetary policy, and the interest rate rises which it entailed, was a disaster. Borrowing costs increased dramatically as interest rates reached 20 per cent. At the same time, companies faced increased wage and salary costs (as we saw above, personal incomes were on the whole rising during this period). Even though inflation was running at quite high levels, few companies were able to raise prices in line with it: in 1979 the big price rise was oil, and in 1980 it was nationalized industries and VAT increases which accounted for much of the increases in industrial prices. The evidence indicates that manufacturing companies, particularly in export industries, were raising prices at rates below the inflation rate. With costs rising fast, and prices not matching them, something had to give, and it was company profits. The average post-tax real rate of return almost halved in 1980, to the very low level of 2.9 per cent for non North Sea companies. Many firms began making losses.

Under these circumstances, firms reacted in the obvious and logical way: they attempted to lower their current costs by reducing their current output. Firms began to supply finished goods not by producing them but by running down their stocks of such goods. Simultaneously, they reduced their stocks of raw materials, which lowered the anent demand for such materials. This lowering of current output led rapidly and inevitably to reductions in the workforce. The object of the exercise was to cut day-to-day running costs and to reduce debts to the banks, but the effect was to create a recession. For the amounts involved were very substantial: in 1980 the turnaround in inventories was approximately 43.5 billion, or 3.2 per cent of GDP.

22 • THE BRITISH ECONOMIC CRISIS

This alone more than accounted for the overall fall in output. The government had, in effect, created this response by attacking the financial positions of companies.

So the monetary policy, operating through interest rates, produced an immediate recession. This was compounded by a further effect of high interest rates, namely a rise in the value of the pound. One feature of the world economy is the existence of large quantities of 'free-floating' capital which moves wherever interest rates are highest. When the interest rate rises, the foreign exchange markets either reflect a movement of such capital into Britain, or anticipate it. This happened: the exchange rate rose sharply. Since this meant that the pound was exchanging for more dollars, Deutschmarks, etc., then it also meant that the foreign currency prices of British exports were also rising. This meant problems for export industries, not so much in the short term (because most export goods are ordered well in advance) as in the winning of new orders. Prices of British goods abroad are determined by three factors; firstly, their costs of production - especially labour costs - inside Britain, secondly exporters' profit margins, and thirdly the exchange rate which links Britain to the rest of the world economy. In 1980 both costs and the exchange rate were rising, and British goods became much less competitive in price terms (though it should be borne in mind that 'non-price competition', in terms of quality, design, meeting of delivery dates etc., is also extremely important in export markets). Between the beginning of 1979 and the end of 1980, the so-called 'effective exchange rate' rose 21.6 per cent and wage and salary costs per unit of output in manufacture rose 36.6 per cent. This added up to a decline in the competitiveness of British goods, according to the International Monetary Fund measure, of about 50 per cent: a change almost un-precedented over such a short period. In the face of these developments, exports held up fairly well, mainly due to exporters making great efforts to keep their prices down - export prices rose by well under half the rise in costs of production. But imports soared, since the stronger pound made them relatively cheaper; the recession intensified as British producers began to lose out in their own home market.

The other key element in the Thatcher government's economic

TIIE CRISIS BEHIND THE RECESSION • 23

strategy has been an attempt to control and reduce government spending. The argument here was that government spending was at an excessive level, which both inhibited the operation of the free market economy (by distorting demand and raising interest rates) and fuelled inflation through the government borrowing which such spending entailed. Two points should be made about this attempt. The first is that total public expenditure has not significantly fallen; in fact as a proportion of national income it has risen under Mrs Thatcher. This is partly because the recessionary impact of the monetary policy has simultaneously increased the government's ex-penditure (on social security and unemployment benefit, for instance) and reduced its income from taxes (for when employment and income falls, the government's tax take falls). But also the government has not attempted to cut expenditure so much as redistribute it: away from some areas (such as education) and towards others (such as defence). This has altered the pattern of government demand for goods and services, with important impacts on some suppliers. The second point is that there has been a sharp fall in capital expenditure by the government: that is to say, programmes of construction and renewal of equipment and buildings have been curtailed. In 1981 such capital spending had fallen by almost 40 per cent from the 1979 level, and by about 60 per cent from the level of ten years before. This is an important aspect of the massive decline in the construction industry.

A WORLD RECESSION?

The analysis of the Thatcher recession presented above has emphasized the effects on Britain of its own government's policy. This approach stands in sharp contrast to the government's account of the recession, which leans heavily on the existence of a 'world recession'. This works simultaneously as a defence of Mrs Thatcher (everyone else is facing the same difficulties as us, therefore it can't be her fault) and as an explanation of our problems, a description of their cause (we are suffering unemployment because the world recession is hurting our economy). To what extent is this government account plausible?24 THE BRITISH ECONOMIC CRISIS

There is no doubt that the international environment, at the time the Thatcher government began to implement its policies, had taken a turn for the worse. The price of oil had risen by 45 per cent between 1978 and 1979, and by a further 68 per cent in the following year. There was a slowdown in the growth of world trade. Interest rates were fluctuating sharply but also moving upwards in Europe and the USA. And all of this was occurring against the background of general instability and slow growth in the world economy in the 1970s.

Can such developments account for the British recession? Here it is worth asking the obvious question, namely, in what ways can international trends affect the British economy? Two possibilities stand out. The first is that the international economy is for some reason contracting, and this is leading to either a slowdown in the growth of demand for UK exports, or an actual decline in the demand for British goods. This would almost certainly push Britain into a recession. The other possibility is that world interest rates might rise, forcing Britain to keep pace, and that this would depress the UK economy, possibly through the kinds of mechanisms outlined in the section above on the 'Thatcher recession'.

Only the second of these possibilities seems to have any plausibility. The UK government was, as we have seen, committed to a rise in interest rates because they believed this would help in controlling monetary growth. A rise in world rates might then mean that British rates would have to rise by more than previously would have been necessary to achieve the same effect. On theoretical grounds this could easily be disputed, but it should also be said that, since the government had the option of not adopting this policy, it could have avoided excessive interest rate rises, and therefore it can't blame its problems on the world economy. The first possibility — a decline in demand for British goods — can also be discounted. This is because, although world trade slowed down in 1979, it was in fact still growing. The crux of the Thatcher recession was a decline in manufacturing, yet world trade in manufactures grew by 5.7 per cent in 1979 and by 4.6 per cent in 1980; this could not, therefore, be the cause of Britain's manufacturing troubles. And in general the so-called world recession took this form: slowdowns in growth rather than the absolute falls suffered by Britain. Table 1, which compares Britain with the countries

THE. CRISIS BEHIND THE RECESSION 25

of the of OECD (i.e. Britain's major industrialized neighbours: the USA, Japan, W. Germany, France, Italy and Canada), shows this clearly for income and employment

Table 1 . Changes in income and employment (%)

1980 1981 1982

National income

-2.1 -2.2 +1.25 Britain

+1.0 +1.2 +0.5 OECD average

Employment

-2.3 -4.7 -2.5 Britain

+0.5 +0.1 -0.5 OECD average

Source: OECD Economic Outlook, July 1982 Table 5, p.20.

At a time when employment was falling by 7 per cent in Britain, it was actually increasing among the UK's OECD partners. Since then the picture has worsened in those countries. Yet two simple points should be made about the development of the world recession. The first concerns timing. The world recession is relatively recent, and Britain entered its own recession before the world recession really got going; on chronological grounds alone it seems difficult to make the world recession the source of Britain's troubles. Secondly, we should remember that all countries have faced much the same sort of international problems. Yet the other OECD countries, facing the same international environment, have not suffered recession on anything like the British scale; Britain's unemployment and output losses have been quite disproportionately greater than those of any other advanced country. Once again, the conclusion is that Britain's problems cannot be laid at the door of a world slump. Mrs Thatcher needs some other line of defence.

CAN THE 'THATCHER RECESSION' BE REVERSED?

The primary impact of the 1979-81 recession, therefore, was on the financial position of companies. In response to a monetary squeeze,

26 • THE BRITISH ECONOMIC CRISIS

and high interest rates, they contracted their output and their em-ployment, and satisfied both their customers and their bank managers by running down their stocks of goods, and their inventories of raw materials and work in progress. As earnings - for those in work - continued to rise, profits fell sharply.

The running-down of inventories explains why a collapse in output has not entailed a collapse in consumption (at least not yet). Perhaps it explains also what many people regard as a certain apathy on the part of the British public in the face of the recession. The absence of protest and unrest is to do with the absence of harmful effects. It is only relatively small minorities who have been really hurt by the recession: the poor, the unemployed, the industrial capitalists.

One conclusion which might be drawn from this account of the 'Thatcher recession' is that it is reversible. Lower interest rates, easier credit, a lower exchange rate, more government spending, perhaps some tax cuts: would not such a programme - in effect the reverse of that adopted by Mrs Thatcher so far - have exactly reverse effects? To some extent the answer must be yes: many industries are operating below capacity, and could respond to increased demand with increased output and employment. Increased government spending, particularly on construction, Might have a strongly stimulating effect on the economy. Even without positive measures for expansion, the economy is likely to grow from the depths of the recession, and this in fact began to appear in 1982 and 1983. But whether such growth can be sustained, and whether it constitutes a 'recovery' must remain doubtful.

Two important problems should be kept in mind. The first is that so many firms in so many industries have collapsed or permanently contracted their capacity, that it must be problematic whether British manufacturing could actually respond to any sustained increase in demand. Historical experience suggests that it is far easier to contract output - to close down companies and factories - than it is to expand it so the Thatcher recession may not, purely on that score, be anything like fully reversible. The second problem is that of imports. British manufacturing appears increasingly unable to compete with imports of foreign goods, and there are good rounds for thinking that any expansion of demand will be spent primarily on imports. All the

THE CRISIS BEHIND THE. RECESSION • 27

current evidence suggests that this is the case, and thus any growth in incomes will do little to alleviate the problems of unemployment and stagnation in UK manufacturing.

INFLATION AND PRODUCTIVITY: A SUCCESS STORY?

In the face of the recession, not everything has been gloomy for the government, however. It has been able to point to two indicators of the success of its policies: a fall in the inflation rate, from a peak of about 18 per cent per annum to under 5 per cent and falling, and an increase in manufacturing productivity (output per person per hour) of about 12 per cent from late 1979 to late 1982. Naturally enough, the government has seen these developments as the harbingers of recovery. To what extent is this interpretation justified?The main difficulty in interpreting the inflation and productivity figures lies in the fact that they have occurred during a very deep recession, and this prompts questions about whether they will be maintained in any recovery. In terms of the inflation rate, we would expect it to fall in a recession of this magnitude, since firms are desperate for markets and their prices will be constrained accordingly, while workers moderate their pay claims because of anxiety about unemployment. The inflation rate has also been helped by unusually low food prices in roll; an almost certainly transient phenomenon. It should be noted that the fall in the inflation rate has not been an effect of the government's monetary policy, which has not been particularly effective in controlling the money supply. Thus decreases in the inflation rate seem to stem more from the effects of recession than from strictly monetarist policy. Whether or not the inflationary process has been halted in Britain remains, therefore, an open question. At the moment, claims about success in beating inflation are premature: they will be justified only if inflation remains low when output recovers.

The productivity question is more complex. Often, in recessions, productivity falls due to firms 'hoarding' labour (because it is often difficult to regain skilled labour quickly when the recession ends). So output falls more than the labour force, and consequently output per worker declines.

28 • THE BRITISH ECONOMIC CRISIS

However, the recession of 1979-81 was much more severe than the mild cyclical recessions of the past. Firms appeared to take the pessimistic — and apparently justified — view that recovery was a long way off; consequently they shed labour and closed down lines of production. At the same time many firms went out of business entirely. Now where this happened — where production lines or whole firms were closed down — one would expect that they were unprofit-able because their productivity was low. That is to say, they had less than average productivity. But it is an arithmetical truism to say that when less-than-average productivity processes close down, then average productivity rises for the economy as a whole. There may be no actual productivity increase in remaining firms — the whole thing would thus be a statistical illusion resulting from the disappearance of less-than-average-productivity firms and processes. Again, it is too soon to say that 'success' can be claimed.

Leaving aside these hesitations, however, let us suppose that recovery really is under way, that the slow growth of late 1982 to early 1983 will be maintained, and that it will be possible to regain the output levels of late 1979, when the first effects of the Thatcher recession began to be felt. This implies an increase in national income of about 5 per cent, and an increase in manufacturing output of about 18 per cent from the bottom of the recession. No doubt this would be hailed as a major achievement, but it should be remembered that to return to the income and output levels of 1979, which marked Britain as the poorest and most decrepit of the advanced economies, would really be little cause for celebration, for at that time Britain was already the 'sick man of Europe', a vulnerable economy at the end of a long period of poor performance and relative decline.

THE LONG-TERM CRISIS — 1945 AND AFTER

Tracing the post-war decline on which the Thatcher recession has been superimposed involves looking at the economy in a comparative context, setting its performance against those of its competitors. Because of the competitive trading environment in which Britain exists, the 'health' of the British economy depends not only, for example, on how fast productivity is growing within it, but also on how fastTHE CRISIS BEHIND THE RECESSION • 29

productivity is growing relative to Britain's competitors. Britain is only geographically an island; economically it is tightly bound up with an international economy. International comparisons are not simply, therefore, of academic interest, they are part and parcel of understanding what is going wrong in the UK economy.

The 'performance' of an economy is not necessarily easily captured in figures. How well an economy is working, for those who live within it, depends on a number of things including:

(a) how fast it is growing;This section will concentrate on Britain's record in growth and productivity, both of which have been relatively poor.

(b) how efficient it is, in getting the best from the resources available;

(c) the level and growth of productivity, or output per person (which helps to determine competitiveness and levels of income); and

(d) the distribution of income.

The post-war development of the world economy has consisted of two main phases of development. The first runs from approximately 1950, when the problems of post-war industrial reconstruction were at least beginning to be solved, to 1973, when the OPEC price rises installed a period of slower growth which has lasted to the present. In both of these major phases Britain's rates of economic growth were slower than those of comparable advanced economies, as Table 2 indicates.

Clearly, in each of these periods, Britain's performance was well below average: in fact its growth rate, during the post-war boom, was the lowest of any industrialized country (though it was also, it should be added, the highest that Britain had ever achieved). In the post-1973 recession Britain's performance was second-worst: only Switzerland, which suffered a sharp though short-lived deterioration in its economy, did worse. The ratio between Britain's growth rate and the average growth rate declined during the post 1973 period (in 1950-73 the U K growth rate was approximately 40 per cent below the average growth rate; in 1973-9 it was 50 per cent below). One interpretation of this would be that Britain's performance in the seventies was not simply due to a slowdown in the world economy; but was also due to the fact that it handled the slowdown worse than other countries.

30 • THE BRITISH ECONOMIC CRISIS

Table 2. Growth of output 1950-79 (GDP, constant prices)

1950-73 1973-79

4.7 2.5 Australia

5.4 3.1 Austria

4.1 2.3 Belgium

5.2 3.2 Canada

4.0 2.1 Denmark

4.9 2.3 Finland

5.1 3.0 France

6.0 2.4 Germany

5.5 2.6 Italy

9.7 4.1 Japan

4.8 2.4 Netherlands

4.0 4.4 Norway

3.8 1.8 Sweden

4.5 -0.4 Switzerland

3.0 1.3 UK

3.7 2.7 USA

4.4 2.5 Average

Source: Angus Maddison, Phases of Capitalist Development, Oxford, 1982, Table 3.1, 45.

Britain's performance in terms of productivity - or output per person - was also weak over these two periods. The level of productivity and the rate of growth of productivity matter for two central reasons. The first is that output per person has a large bearing on income per person, and hence on standards of living; it is not the only determinant of real income, but it is an important one. The extraordinary growth in the amounts of goods and services available to the populations of the advanced countries over the past hundred and fifty years is essentially clue to a dramatic growth in productivity. Looked at from another angle, productivity is a measure of efficiency, for it plays a significant part in fixing the costs at which output can be produced. In a competitive world - and a large proportion of Britain's output must compete, tither in export markets or against

THE CRISIS BEHIND THE RECESSION • 31

imports within Britain - levels of productivity matter a great deal in determining the costs and hence competitiveness of products.

Rates of growth of productivity are vitally important too. If two countries begin with approximately the same level of productivity, and one then has a higher growth rate of productivity, then the high growth country will tend to generate both higher incomes and lower prices and a competitive advantage. This process can become cumulative, with increasing disparities emerging between countries. This is indeed what has happened to Britain. Table 3, which looks again at the two broad stages in the post-war period, indicates something of the productivity gap.

Once again there was a sharp slowdown in the second period, and once again Britain performed worse than average, and much worst

Table 3. Rates of productivity growth (%), 1950-79 (Annual average compound growth rates of GDP per man-hour)

1950-73 1973-79

2.6 2.6 Australia

5.9 3.8 Austria

4.4 4.2 Belgium

3.0 4.2 Canada

4.3 1.6 Denmark

5.2 1.7 Finland

5.1 3.5 France

6.0 4.2 Germany

5.8 2.5 Italy

8.0 3.9 Japan

4.4 3.3 Netherlands

4.2 3.9 Norway

4.2 1.9 Sweden

3.4 1.3 Switzerland

3.1 2.1 UK

2.6 1.4 USA

4.5 2.7 Average

Source:Angus Maddison, Phases of Capitalist Development, Oxford, 1982, drawn from Table 5.1, p. 96.

32 • THE BRITISH ECONOMIC CRISIS

than its main industrial rivals (Germany, Japan, Italy, France) though rather better than the USA. This last phenomenon has a ready explanation, however. For most of the post-user period the USA has been the world technological leader, and one effect of this is that other countries could follow the US path, using US technologies without the pains and problems and costs of developing them. 'Follower' economics can thus often attain higher productivity growth rates than 'leader' economies, though they may not be able actually to overtake them. But Britain's productivity growth has rarely reached the rates achieved by other 'followers', and has in general been markedly lower than comparable economics. These figures of course refer to the whole economy; but it should be noted that the differ-entials in productivity have been confirmed by a number of studies at plant level, in which output per worker, even in similarly equipped plants producing similar products, has been shown to be markedly lower (by up to 50 per cent) in Britain.

The most obvious effect of this record of slow growth and slow productivity growth has been a stark relative decline in British

Table 4. National Income, per person (1979 US Dollars)

13,920 Switzerland

11,930 Sweden

11,900 Denmark

11,730 W. Germany

10,920 Belgium

10,700 Norway

10,630 USA

10,230 Netherlands

9,950 France

9,640 Canada

9,120 Australia

8,810 Japan

8,630 Austria

8,160 Finland

6,320 UK

5,250 Italy

Source: World Bank, World Development Report 1981, Table 1, p. 135.

THE CRISIS BEHIND THE RECESSION • 33

incomes, compared with the same group of countries. There are serious problems in making cross-country income comparisons, but the figures in table 4 give at least a broad indication of the differences involved.

Against this picture of poor performance and low income must be set a further image: that of Britain at the beginning of the post-war epoch. Then, Britain was not at the bottom of the table but near the top. It was a technically advanced, high-productivity economy with a major industrial base, sophisticated research and development capabilities, a highly skilled workforce and a capable financial system. The relative decline traced in the statistics above means that some-thing has gone seriously wrong. Moreover things have been getting considerably worse: concealed within the long-run averages of the above tables is a sharp deterioration in the mos. The figures above show that in the post-war period Britain's growth of output and income was slow compared with its competitors. But in the most, crucial parts of the British economy simply stopped growing. Instead, we have seen the historically unprecedented spectacle of an advanced economy suffering severe absolute fall in industrial and manufacturing output. These falls are at the core of Britain's economic crisis.

THE INDUSTRIAL COLLAPSE

The British economy is built on an industrial base, by which economists normally mean four types of activity:

- mining, quarrying, oil, etc.;All of these industries are important, though manufacturing is often accorded a special place since it provides the bulk of exports and jobs. To set what has been happening in context, we should note that from the mos, and right through the fifties and sixties, British manufacturing output grew at about 30 per cent per decade. In the early mos it continued to grow, but that growth was then swamped by a mid 1970s contraction followed by the Thatcher recession. The outcome was an absolute fall, over the decade, of over 8 per cent.

- construction;

- public utilities: gas, electricity, water,

- manufacturing.

34 THE BRITISH ECONOMIC CRISIS

There is no precedent for this in British economic history over the past two centuries. And other industrial output fell by a similar amount. Only the massive growth of North Sea oil production prevented an overall fall in total industrial output; even including oil, there was only 1 per cent growth over the decade, a derisory amount. Table 5 - in the form of an index with 1975 equal to 100 - illustrates the collapse.

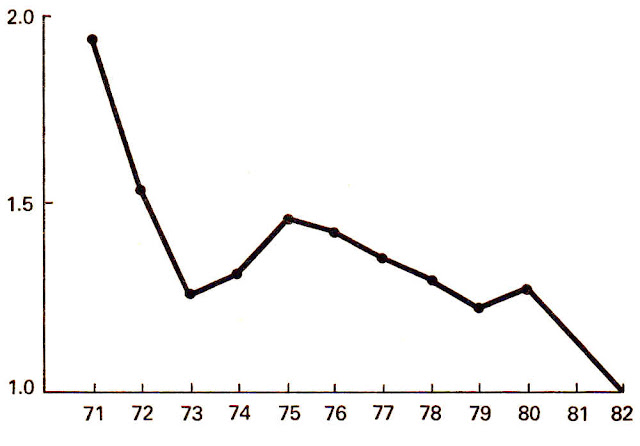

Table 5. Manufacturing and Industrial Output 1971-81 (1975 = 100)

1971 1972 1973 1974 1975 1976

97.5 100.0 108.4 106.6 100.0 101.4 Manufacturing

99.7 101.4 109.4 105.1 100.0 102.1 Tot. industrial production

99.6 101.7 109.2 105.1 100.0 100.7 ... less North Sea oil

1977 1978 1979 1980 1981

103.0 104.0 104.4 95.5 89.6 Manufacturing

106.1 110.3 113.1 105.9 100.6 Tot. industrial production

101.9 104.1 104.3 96.9 90.6 ... less North Sea oil

Souce. National Income and Expenditure, 1982, Table 2.4, p.21.

Again, it should be remembered that these figures are averages for whole sectors; things look much worse even than this if we look at particular industries within the manufacturing sector. 'Table 6 shows decline over the 1970s for a wide range of important industries.

This collapse in output has been paralleled by falls in employment, both in manufacturing and in industry generally. Here, however, the long-run decline began in the mid 1960s (see table 7).

These figures reflect what is sometimes called a process of 'de-industrialization'. To return to the comparative context, it should be emphasized that in this process Britain is unique. Certainly, in the economic turmoil of the 1970s, other countries have suffered losses

THE CRISIS BEHIND THE RECESSION 35

Table 6. Index of UK manufacturing decline in the 1970s (1975 = 100)

1973 1979 Output

120.6 105.3 -13% Coal and petroleum products

129.5 104.4 -35% Metals Ferrous

117.1 105.5 -13% Metals Non-Ferrous

97.1 91.4 - 6% Mechanical Engineering

95.4 78.1 -18% Shipbuilding

118.8 99.3 -16% Motor Vehicles

120.7 94.6 -22% Bricks, cement

117.1 96.7 -17% Textiles

Source: John Hughes, Britain in Crisis: De-industrialization and how to fight it, Nottingham, 1982, p. 27.

in output and employment. But nowhere have the falls been in any way comparable with those of the UK. Moreover, in many advanced economics - Canada, the USA, Japan, Italy - industrial employment has actually risen.

So something very significant has happened within the British economy. A long process of relative decline has turned into an absolute contraction in Britain's industrial base. Should this, however, be a cause for concern? There are those who argue that it is not. Some suggest simply that the balance of Britain's economic activities is

Table 7. Employment in industry and manufacturing (million)

June

1966 1970 1974 1981 % Decline

9.16 8.91 7.87 6.04 34.1 Total Manufacturing

11.85 11.09 9.90 7.87 33.8 Total Production Industries

Source: A. P. Thirlwall, 'De-industrialization in the United Kingdom', Lloyd's Bank Review, 144, p. 25.

36 • THE BRITISH ECONOMIC CRISIS

shifting, away from manufactures and towards 'service' activities; consequently, the decline in manufactures is a natural consequence of a change in what people want to spend their incomes on. But if this is the case, there is no necessary reason why a long-term increase in unemployment should result: a shift in the forms of employment, yes; unemployment, not necessarily. Moreover, the British people do not seem to be consuming fewer manufactured goods - they are consuming fewer British manufactured goods, and much more in the way of imports. Others argue - and these have included the former Chancellor, Sir Geoffrey Howe - that the slowdown in manufacturing is a response to the rise in North Sea oil production. The arguments here are quite complex, but it seems enough to point out that the problems in UK manufacturing and other industrial production began well before North Sea oil came on stream. North Sea oil has indeed had significant effects on the economy, but of course does nothing to explain why our performance relative to our neighbours has been so poor for so long.

So such arguments, reassuring though they are, do not seem to get us very far. Against them, we could suggest that the de-industrialization of Britain is in fact a major historical development. Since it is indeed unprecedented it is difficult, to say the least, to outline its implications for the future. The argument here is that it threatens the long-term viability of the British economy, which is therefore at a significant turning-point in its history. But this requires a framework within which to set the facts outlined above, one which will enable us to understand their wider significance for the way the British economy functions.

2

Improvements in the incomes, living standards and wel-fare of any country's people are in large part an effect of success in generating economic growth. Of course, growth is by no means the only contributor to these things, nor does it guarantee anything: much depends, for instance, on how its benefits are distributed among the population. And certainly growth brings many new problems in its wake. Even so, it remains the basic process by which problems of poverty, unemployment and low incomes - Britain's problems - can be overcome.Growth and Trade —

Components of the Crisis

The previous chapter showed that Britain's growth record has been very poor: in the 1950s and 60s Britain's growth rates were the highest it had ever achieved. Yet they were dismal when set against those of comparable economies; and in the 70s even that slow growth evaporated and an absolute decline began. This chapter secs out an analytical framework for understanding these developments, within which some of the basic elements of Britain's decline can be identified. It is concerned essentially with two types of problem:

1. The nature of economic growth. What does economic growth actually consist of, and what are its mechanisms? In particular, what is the relationship between technological change and economic growth?

2. The role of international trade for an economy like that of the U K. Why does the trading position of the economy matter, and what is the relationship between it and the economy's growth record and growth prospects?

38 • THE BRITISH ECONOMIC CRISIS

ECONOMIC GROWTH

Economic growth is an increase in the total output of an economy overtime. It can result from two quite separate processes. On the one hand there may be a growth in output resulting simply from an increase in the number of workers and an increase - sufficient to employ them - in the economy's stock of machines and equipment. This is, in other words, an expansion of existing activities; it means doing the same sorts of things on a wider scale (in fact, economists sometimes call this 'capital-widening' growth). Such growth involves an increase in total output, but no increase in output per person, or in income per person. We can call this 'extensive' growth.On the other hand there is a further dimension of economic growth in which, in the words of Professor Simon Kuznets - one of the most influential of modern growth theorists - 'we identify the economic growth of nations as a substantial increase in per capita or per worker product.' [1] Here, economic growth occurs not because of more workers but because of increased output by existing workers: in other words, productivity growth. We might call this 'intensive growth'. Now this 'intensive' productivity growth is a complex process involving many activities ranging from basic scientific research through to the development and application of quite small-scale skills in production. But in general it involves changes in the capital stock; that is, changes in the array of plant, equipment, machines and so on with which workers product. These changes take the form either of increases in the amount of equipment available for each worker to work with, or improvements in technology which increase either the quantity or quality of output which can be produced with available quantities of capital and labour.

Clearly these two types of growth - extensive and intensive have gone hand in hand in the course of the development of the advanced economies. But it is the second type, based on productivity growth, which is more important and on which the attention of economists has focused. The reason is obvious: rises in output per head are one of the few paths to rising incomes and standards of living and shorter working periods. Since these are among the central objectives of economic activity as such, the importance of intensive growth stands

GROWTH AND TRADE — COMPONENTS OF THE CRISIS • 39

out. Another reason is that there is considerable research evidence to suggest that productivity increases, resulting from broad technological improvements, have made the most important contribution to the rapid economic growth of the advanced economies since 1850. The massive rises in income, and the dramatically shortened working week, which have characterized Western economic development, are the result of intensive forms of growth.

So what is entailed by this intensive, productivity-increasing mode of growth? What kinds of activity promote it or retard it? The most general point is that intensive growth involves a process of almost continuous change within the economy. This change occurs along three main axes, to do with the kinds of activities on which the economy is based (that is, its structure); with the kinds of products which are produced (its output mix); and with how products are produced (its technology). We can consider each of these types of change in turn:

1. Structural change

Structural change means simply a shift of emphasis within the activi-ties which make up the economy; by itself it can raise productivity and generate growth. For example, in many economics agriculture is less advanced technically and less productive than manufacturing. If workers move, therefore, from agricultural work into a manufacturing job, their productivity will automatically rise and output will grow. These kinds of shifts have historically been important in raising productivity, but are obviously limited; only so many people can be moved out of agriculture, and the productivity improvements gained thereby are a once-for-all affair. But structural shifts of this type remain important. Recently, for example, manufacturing employment dropped in the UK - as we have seen - while service employment has risen; since services are, on the whole, less productive, the result a fall in average productivity and in overall output.

2 Changing the product mix

The general mix of products being turned out by an economy clearly changes over time. In the first place, some products simply drop out ut production: whale-bone corsets and horse-drawn wagons are no

40 • THE BRITISH ECONOMIC CRISIS

longer made. Others remain but fade from significance, like lace, or horseshoes. And completely new products emerge, such as - in the twentieth century - electrical goods and, more recently, electronic and microprocessor-based products. Finally, within this broad process of change, some things remain in production, yet change their character so much as to be, in effect, new products: transistor as opposed to valve radios, digital as opposed to mechanical watches. We could sum up by saying that there is continuous product change in terms of design characteristics, technical attributes, materials and functions. The question is, what is the economic significance of such change?

There is in fact an important relationship between product change and economic growth. We can start by noting that, in order for output to grow, the demand for that output must also be growing. For any particular country within the world economy, product demand can grow for two reasons: either the total market is growing, or that country's share of the market is growing. Now when the world economy grows, when world incomes grow, the demand for all indi-vidual products also grows. But these demands for individual products do not grow at the same pace; some, in fact, grow faster than others. Over the past ten years, for example, world income and demand have grown; but the market for stereo equipment, for instance, has grown much faster than the market for nuclear power stations. As a general rule, as incomes grow, the demand for manufactured products grows faster than the demand for agricultural goods.

This suggests that a first condition for growth is that a country must be producing goods for which demand is growing; often, this will mean new products, since the expansionary possibilities here will usually be greater than for older products whose demand pattern is more stable. After the Second World War, for example, consumer durables such as refrigerators and washing machines - which in Europe were essentially new products - were in strong demand and became an important motor of post-war growth. At the present time, demand for consumer electronics, notably video equipment, is growing, and this promotes growth in Japan, the only significant producing country.

But it is not, by itself, enough to be producing in new and expanding

GROWTH AND TRADE - COMPONENTS OF THE CRISIS - 41

product groups. Products also have to compete to maintain their share of the market, and for both new and old products this also means change: the development of new designs, of new standards of performance, and so on. The motorcar of' the 1980s is very different from that of the 50s; in this field, as in many others, world competition relates not just to prices but to the technical standards of the product. If producers are to stay in business they must keep up, therefore, with the frontiers of technical change in the design of the product. These considerations suggest that product change is central to economic growth simply because without it, demand is unlikely to grow. Thus growth is not just a matter of efficiency, but of efficiency in producing the right sorts of things: there is no percentage in being the world's most efficient producer of whale-bone corsets. Moreover, from this perspective, 'de-industrialization' can be seen not as a bad thing, necessarily, but as a vital concomitant of growth. 'De-industrialization', in the sense of running down industries in declining product areas, and building them up for products with high and rising demand, should be normal practice for a successful economy.

3. New processes:

changing methods of production The other crucial aspect of change is not in products but in the processes of production through which they are made. New products generally entail new production techniques. But even where products remain broadly the same - as in steel, or chemicals - methods of production change. Such changes can take a wide variety of forms. Some may be very dramatic, shifting the whole nature of production: in chemicals, for example, an important shift was from 'batch' techniques to a continuous `flow' process; the analogous shift in cars was from individual assembly - one car at a time - to the production line. Such 'big' changes can also take the form of changes in power sources (oil and electrical power for coal and steam), or materials (plastics for metals), or methods of work organization (the factory for the artisan's workshop). At present, the rapid introduction of robots into manufacturing assembly - made possible by microprocessors - may well be such a 'big' shift.

At a less spectacular level there are frequent small changes in

42 • THE BRITISH ECONOMIC CRISIS

production processes which raise overall productivity. In a competitive world the economy must be flexible along the whole spectrum of such changes; it must keep in touch with 'best-practice' techniques of production, or lose out to its competitors. In processes as with products, the economy must be in the business of continuous change.

Such 'process' transformations necessarily involve changes in the nature of work, in the numbers of people employed, and in the kinds of jobs they do. Here again there must be flexibility, an openness to the possibilities of de-industrialization. A growing and efficient economy must somehow solve the problem of shifting people from declining to growing industries, from low-productivity to high-productivity jobs; it must be able to absorb the consequences of technical change. As a very minimum this involves recognizing and overcoming complex problems of education, retraining, and re-location; but it entails many further problems of industrial policy.

GROWTH AND TECHNOLOGY

To sum these ideas up, we can say that economic growth implies a continuous, multi-faceted process of change: a process which Joseph Schumpeter called 'creative destruction', as old methods and products make way for new. This is nothing other than the process of tech-nological and technical innovation. So the theoretical point in all of this is that growth and technological change go hand in hand; they are indissolubly linked, for it is technological change that makes growth possible, as Professor Kuznets rightly argues,a sustained high rate of growth depends on a continuous emergence of new inventions, providing the hoses for new industries whose high rates of growth compensate for the inevitable slowing down of the older industries. A high rate of overall growth in an economy is thus necessarily accompanied by considerable shifting in relative importance among industries, as the old decline and the new increase in the nation's output [2] (My italics.)This emergence of new inventions and innovations does not, of course, happen by accident. It involves the commitment of resources directed specifically at generating technological progress: in a word, it involves investment. Now investment in technology-based growth

GROWTH AND TRADE — COMPONENTS OF THE CRISIS • 43

means that resources must be committed to two types of activity.

First, there are research and development (R & D) activities, which are aimed specifically at producing new technologies. These R & D activities can range all the way from basic scientific research, via forms of applied technological study, through to the design and con-struction of new machines and products. It is extremely important to note that this R & D activity need not be confined to the direct development of technologies: it can also consist of a search for useful technology imports. At the technological level, the world economy is characterized — as the previous chapter noted with respect to the US growth record — by a distinction between 'leader' and 'follower' economies. Follower economies can and should devote a large part of their R & D activity to obtaining the technologies of more advanced economies. This has been a notable feature of rapid economic development in Western Europe in the mid nineteenth century (using British technology), in the Soviet Union in the 1930s (using US and European technologies), in Western Europe after the Second World War (using American technologies). The most striking example, however, is Japan, which has combined a high level of domestic R & D with a very high level of technology import from Europe and the USA; Japan's remarkable economic growth has been heavily dependent on foreign technologies, but the point is that this has required a substantial commitment of R & D resources aimed at seeking out the most useful, adaptable and profitable techniques for import.

The second aspect of investment is industrial construction itself: the commitment of resources to building up the industries which will either use or produce the outcome of R & D activity. For an economy to grow successfully, these two kinds of investment must be 'adequate' in two different senses. On the one hand, investment must be 'adequate' in volume or amount: a country must devote enough of its income to such investment, so that it has both the ability and the economic capacity to produce a level of output that will maintain its incomes and employment. On the other hand, investment must be adequate in what we might call direction: it must be directed towards viable activities, meaning areas of R & D and pro-duction where there actually will be a pay-off and profits.

44 • THE BRITISH ECONOMIC CRISIS

These kinds of theoretical points about the relationship between technology and growth suggest various propositions about the poor British growth record outlined in Chapter I. Specifically, they suggest that Britain's growth problems have been tied up with a technological weakness. Britain has not devoted enough of its resources to R & D) and production investment; and the resources it has committed have gone to the wrong areas. The consequence has been low rates of growth. Conversely, it could be argued that the success of countries like Japan and West Germany is an effect of success in managing the processes of technological innovation and investment.

These propositions form the first part of a framework for understanding the British predicament. The next two chapters will look at some of the relevant evidence, which suggests that technological weaknesses are indeed at the root of Britain's slow growth problem. However, we also need to ask why this slow growth should involve a crisis, a threat to the viability of the UK economy. Here it is necessary to look at the 'external' position of the economy: at its import-export structure, and its balance of payments, and at the economic role they play in an economy like Britain's. Against this 'external' background we can discern the really worrying implications of the slowdown and end of British economic growth in the 1980s.

THE EXTERNAL PROBLEM

Britain's place as part of an international economy is central to its economic functioning. To some extent this is for geophysical masons: Britain is a small, overpopulated island which needs to import about half its food, and a large proportion of the raw materials used in industry. Obviously it must export to finance such imports. But there is more to the problem of exports than this. This is because the 'balance of payments' - in which Britain's economic relationships with the world are summed up - is not simply a set of accounts. It involves the operation of powerful economic forces which place real constraints on the rate at which Britain can grow, and on the level of income and employment which it can sustain. It sets limits on the kinds of policies which can be adopted. As we shall sec, for an economy like Britain's, manufactured exports and imports play anGROWTH AND TRADE — COMPONENTS OF THE CRISIS • 45

important role within the balance of payments, which is why the growth failures and technological weaknesses - referred to above - have very disturbing implications for the future. But in order to depict the problem accurately, we need to look first at the meaning of the balance of payments and then at its mechanisms; then at the structure of British trade and the prospects for the future.

In essence, the balance of payments records the purchases and sales of sterling and foreign currencies related to two kinds of transaction. The first are called 'current account' transactions; these refer to all imports and exports of goods (such as cars or machinery or food) and services (such as insurance sales or tourist activities). Goods and services are sometimes referred to as 'visibles' & and 'invisibles' respectively. The second type of transactions are called 'capital account' transactions; they refer to the shift of money into and out of Britain for the purchase of assets - shares, bonds, bank deposits, land, plant and equipment, etc.

The ratio at which pounds exchange for other currencies within these transactions is, of course, the 'exchange rate'; it plays an im-portant part in keeping all of these transactions in balance, and every country must have some policy on how its exchange rate is fixed. There are in fact a range of possible exchange rate systems, each with different implications for the economy. One is a system of fixed, unalterable rates, such as the 'Bretton Woods' system which governed the advanced marker economics between the end of the Second World War and 1971. With this system governments fix a definite set of rates, which are changed only at long intervals; for most of the post-war period, for example, pounds exchanged with dollars at the fixed rate of $2.80 = £1, until 1967 when the pound was devalued to $2.40 = £1. In order to keep the rate stable, governments would hold large reserves of gold and foreign currencies, which in Britain were and are held in a special account in the Bank of England called the 'Exchange Equalization Account'. When, for example, Britain imported more than it exported it would need more foreign currency than it was currently earning to pay for the imports; the Bank of England would supply this by running down its reserves. Conversely, when Britain had a surplus of exports over imports, foreign buyers would need extra sterling to pay UK exporting firms; then the Bank

46 • THE BRITISH ECONOMIC CRISIS

would supply sterling in exchange for foreign currencies, which would go into the Exchange Equalization Account, thus increasing UK reserves. In this way the Bank ensured that the supply and demand of sterling and foreign currencies were always in balance at the going exchange rate, and the rate was thus fixed.

At a polar extreme from the fixed-rate system is the 'floating-rate' regime. Here the government supplies neither sterling nor foreign currencies into the foreign exchange markets. In consequence, the supply of sterling into the market (from importers wanting to buy foreign currencies), and the demand for sterling (from foreign buyers of our exports, who need to change their money into pounds to pay UK companies for the goods), can be out of balance. This causes the exchange rate, which is the 'price' of sterling in terms of other currencies, to move. A surplus of exports over imports means a demand for sterling greater than the supply, and vice versa. Thus, in this system, the day-to-day exchange rate can fluctuate quite sharply.

Apart from holding and using foreign currency reserves, there is one further way the government can affect the movement of currency (and hence, in the floating system, the exchange rate). This is by affecting capital movements through interest rates. A rise in interest rates will induce foreign investors to shift their capital to Britain, since they can now get a better return than elsewhere. This has the effect of increasing the reserves (with fixed rates), or pushing up the exchange rate (with floating rates). In principle, therefore, the government can keep the overall supply of, and demand for, sterling in balance by varying the basic interest rate: if there is a surplus on current account (exports are greater than imports) then it can lower the interest rate to produce a deficit on capital account (more capital goes out than comes in). If the capital account deficit exactly offsets the current account surplus, then there will be no change in either reserves or the exchange rate.

At present, Britain operates a system which is somewhere between the fixed and floating-rate models - it is called a 'managed float'. The exchange rate is allowed to float, but the Bank of England intervenes with its reserves to iron out temporary fluctuations. in addition, interest rates also shift to stabilize the rate. So in any one year the balance of payments consists broadly of three items:

GROWTH AND TRADE - COMPONENTS OF THE CRISIS • 47

- the current account balance; - the capital account balance; - the 'balance for official financing': i.e., the change in the reserves as a result of Bank of England intervention. The 'balance for official financing' is equal to the difference between the current and capital account balances; this means that by definition the whole thing sums to zero - the balance of payments really is a balance. In 1980, for example, the current account was in surplus to the tune of approximately £3 billion; the capital account was in deficit by £1.8 billion; and official financing - in this case involving additions to reserves - was approximately £1.2 billion. Net balance: zero.

This particular accounting identity always holds true: the balance of payments is always in short-term balance, or 'equilibrium'.

However, the problem of balance of payments equilibrium goes much further than this. Pearly, if Britain had a serious overall deficit, it could not finance this by running down the reserves over an indefinite period, simply because the Bank of England's foreign currency reserves are finite. Sooner or later they would run out. Then, if not before, the exchange rate would begin to depreciate or even collapse. In theory, this could in itself solve the problem of discquilibrium, since a falling exchange rate means that our exports are becoming cheaper and imports dearer; hence exports would rise and imports fall, and we would move back into basic balance. But this mechanism is by no means as certain as the textbooks tell us, and there would be formidable problems of adjustment (including falling real incomes) along the way.

The upshot of all this is that the basic balance of payments - the current and capital accounts - must be kept broadly in equilibrium. Consequently, the British economy cannot develop in ways, nor can economic policies be adopted, which are incompatible with an underlying balance on our external accounts. We cannot, for example, allow the economy to grow if that growth produces large imbalances in our foreign trade. For a concrete example of the problems here, we can look back to the so-allied `stop-go' cycles of the 1950s and 1960s. This is not just a historical exercise: the basic difficulty it points up is still with us.

48 • THE BRITISH ECONOMIC CRISIS

THE STOP-GO CYCLE

For much of the 1950s and 1960s Britain was characterized by short bursts of expansion in economic activity, followed by bouts of contraction or recession: the 'stop-go' cycle, in which the 'stop' signal was a balance of payments problem. Typically, the cycle would run like this: for one reason or another - possibly to reduce unemployment - the government would attempt to expand the economy. Growth would be induced by raising demand through tax cuts, increases in public spending and so on.This would cause output to rise and unemployment to fall in Britain; consequently incomes would rise, consumer expenditure would rise, and so would spending by firms on raw materials and equipment. But as this happened, the 'external constraint' would begin to make itself felt. The problem was this: with given prices, Britain's exports are essentially determined - in the short term - by world demand, that is, by the level of world income. Imports, however, are determined by the level of income in Britain. So as the government expanded the economy, imports would grow faster than exports, because the world economy would not be matching Britain's short-term acceleration in growth. The result of imports outpacing exports was thus a balance of trade deficit, and a balance of payments crisis. The foreign currency reserves in the Bank of England would fall as Britain used more foreign currency to pay for imports than it earned from exports. The government effectively had only one response to this: to throw the gears into reverse, and slow down the rise in British income. It would, in a word, deflate the economy - reduce spending and incomes by increases in taxes, raise interest rates (which would have the effect of attracting foreign capital), and cut government expenditure, and so on. The 'stop-go' cycle was essentially a short-term process, and in the context of the 1950s and 1960s was not too serious, since both the world economy and the British economy were growing at record rates anyway. (It should be mentioned, perhaps, that the stop-go cycle cannot be held responsible for Britain's poor relative performance in those years, since other countries - such as West Germany - experienced the same problems, if anything in a more severe form).

GROWTH AND TRADE - COMPONENTS OF THE CRISIS 49

But the point of all this - and it is a very important one - is that there was (and is) an external constraint on British growth. It was simply not possible for Britain to grow at a faster rate than that which was compatible with balance of payments equilibrium. And this constraint could be extended to unemployment: Britain could not employ more workers than was consistent with external balance. Moreover, this external constraint is not confined to the short term: it also affects the long-run attainable rate of growth in the UK. THE LONG-RUN CONSTRAINT